Summary

The project

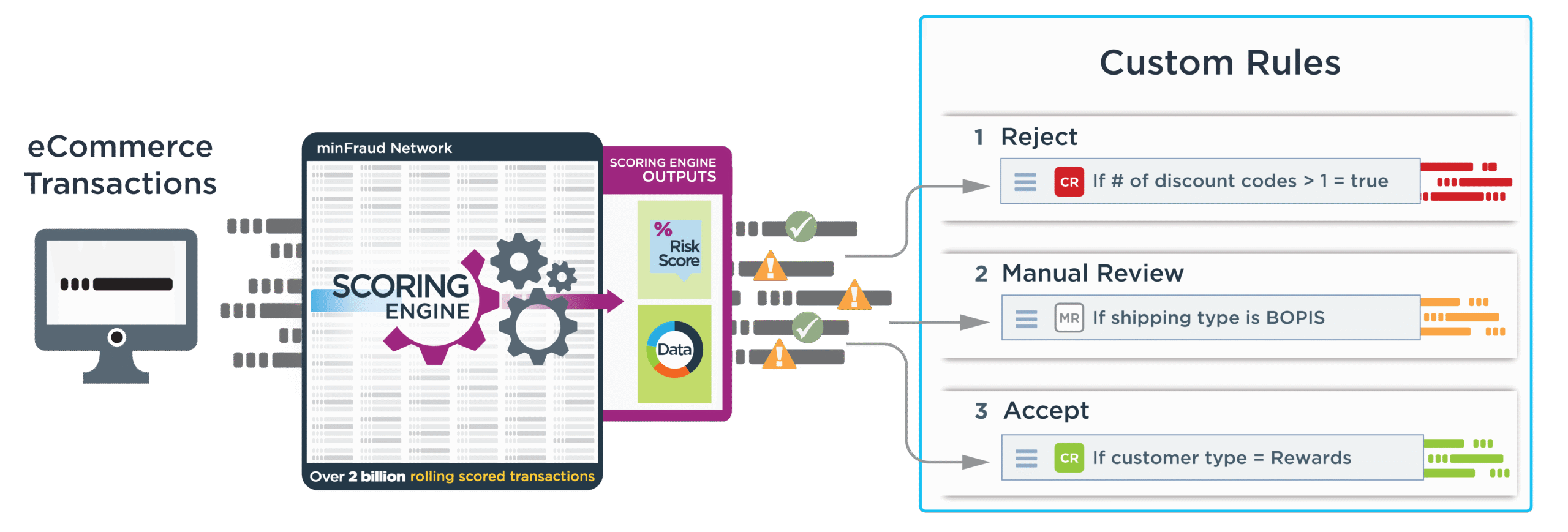

MaxMind’s minFraud product provided machine-learning-based fraud risk scoring for thousands of businesses processing transactions at scale. As the product matured, enterprise customers needed the ability to layer their own deterministic rules on top of AI decisions to support business-specific fraud policies.

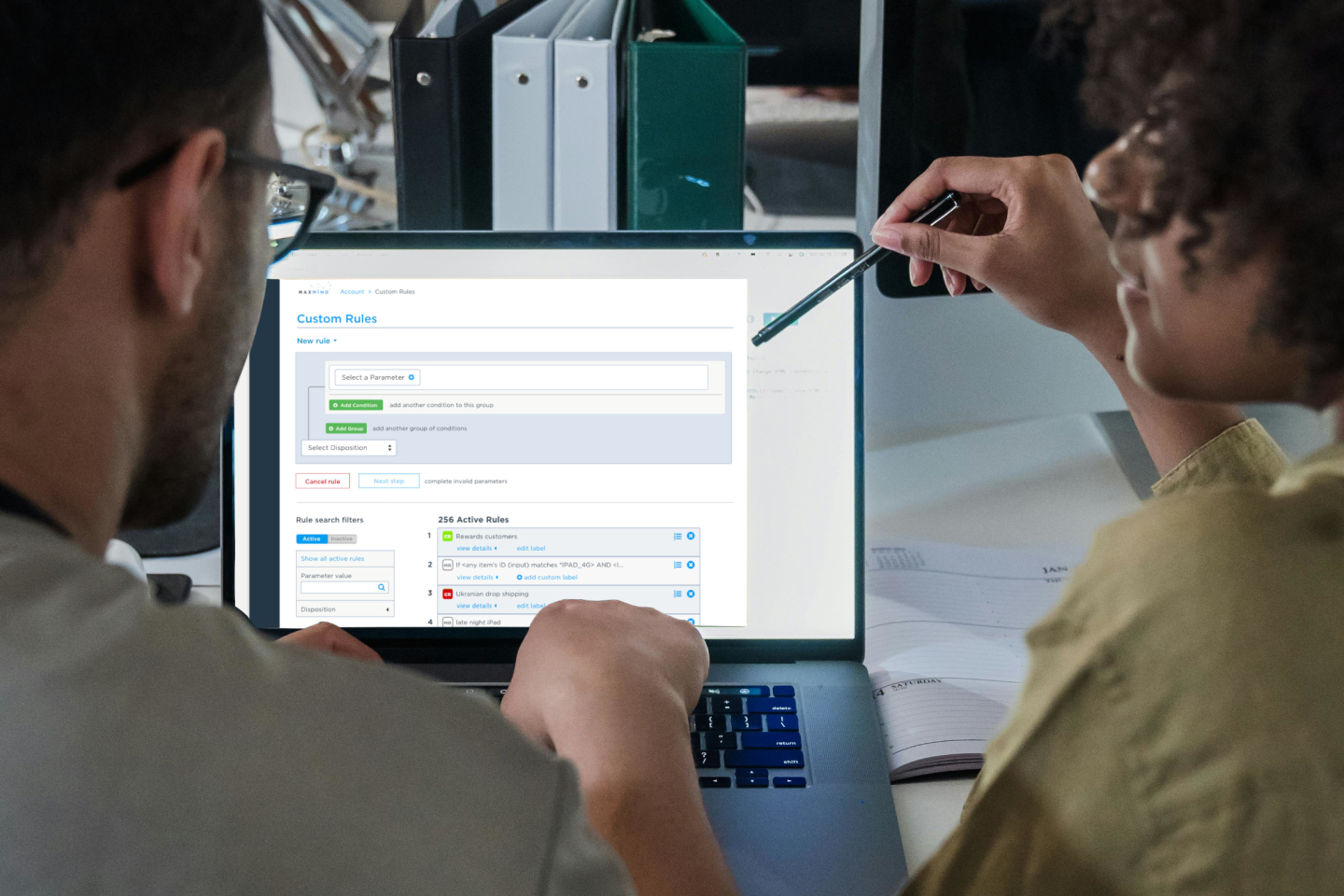

I was brought in to design a new rule-building experience that enabled fraud analysts to create complex, nested decision logic without requiring engineering expertise, while safely operating in a high-risk financial domain.

Core user problem

Fraud analysts needed to define sophisticated rules that combined platform signals, custom inputs, and conditional logic. The existing wizard-based interface limited rules to two conditions and hid global state, making it impossible to express real-world fraud scenarios.

Errors in rule configuration could directly result in fraudulent transactions being approved, leading to chargebacks and financial loss. Users needed power, clarity, and safety in equal measure.

My role, scope, and collaborators

I was the sole product designer responsible for shaping this feature from early problem framing through implementation. I worked closely with a product manager to translate high-level business needs into design requirements, using customer interviews and competitive analysis to refine the solution. The work was developed in close partnership with a dedicated scrum team that included frontend and backend engineers, QA, and a product owner.

The scope extended well beyond interface design. The rule builder introduced net-new functionality layered on top of MaxMind’s machine-learning decision engine and required coordination across UI, backend logic, internal APIs, and customer-facing configuration. Design decisions directly influenced how rules were authored, validated, executed, and exposed to enterprise customers at scale.

Qualitative insights

Through interviews with power users and enterprise stakeholders, I learned that real-world fraud rules were rarely linear. Analysts needed to reason about entire rule sets at once, frequently revisiting and adjusting conditions as fraud patterns evolved.

Users consistently struggled with hidden logic and step-by-step workflows that obscured how one condition affected another.

Quantitative Data

Analysis of existing rule usage showed an 80/20 pattern: most rules were simple, but a meaningful minority were highly complex and business-critical. The system needed to support those advanced cases without overwhelming less advanced users.

Design Approach

Designing for system visibility, not steps

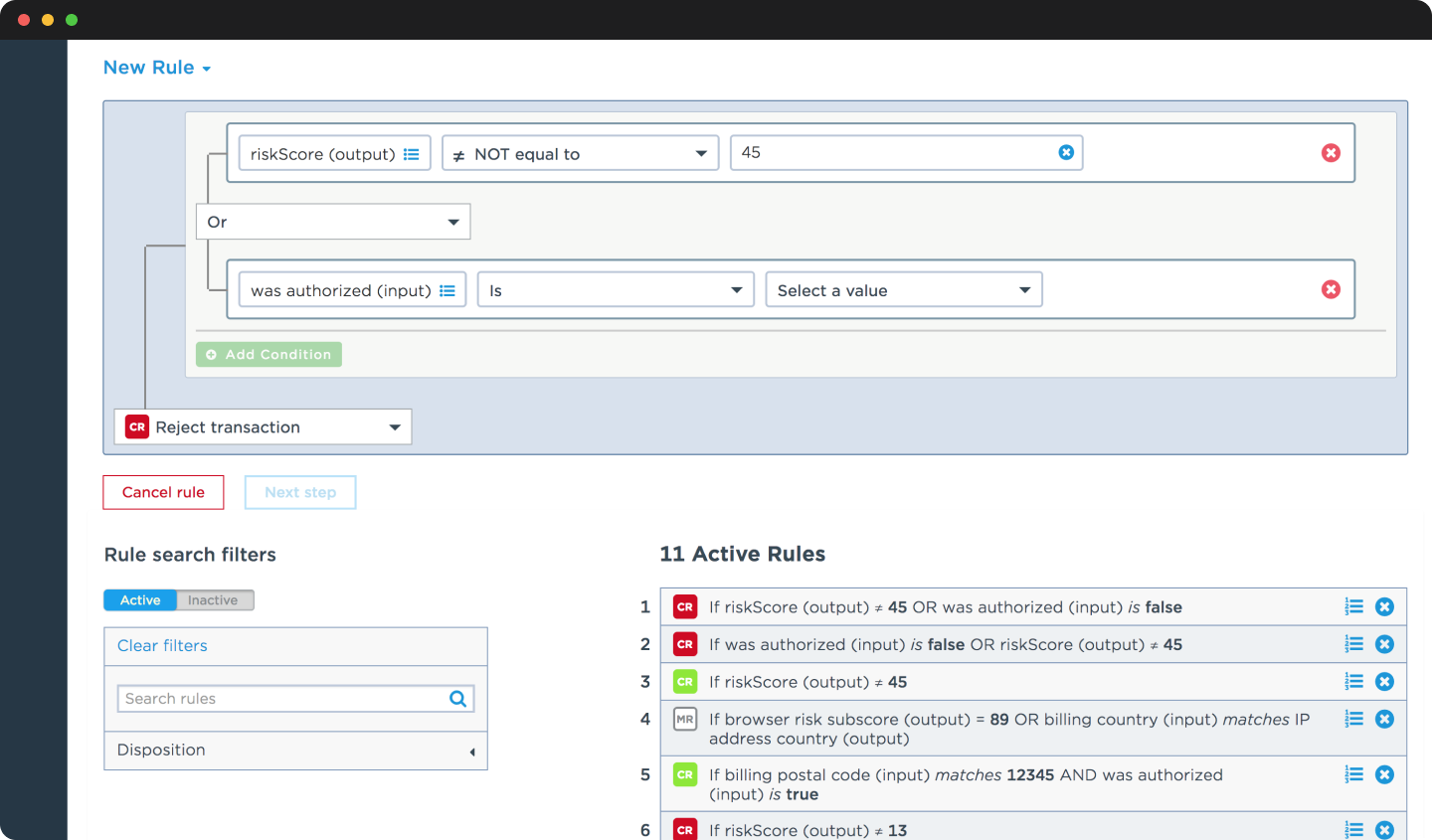

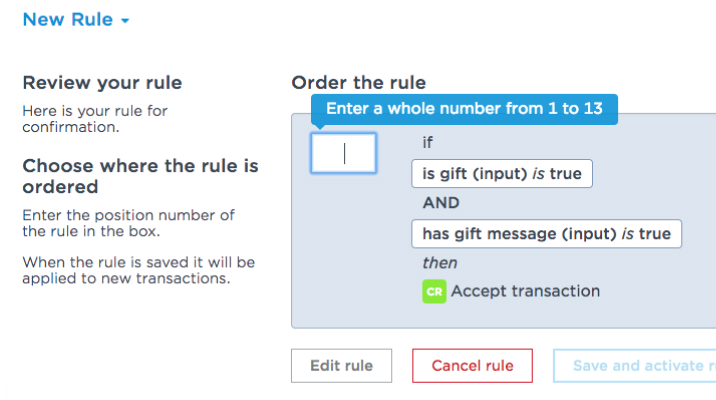

The wizard model assumed rules were linear and independent. In practice, fraud logic is interdependent and stateful. I replaced the wizard with a state-based visual logic model that displayed the entire rule at once.

The step-based wizard made it difficult for users to make corrections, forcing them to backtrack, creating a common abandonment scenario. These issues would only have worsened as the feature scaled.

Supporting complexity through structure

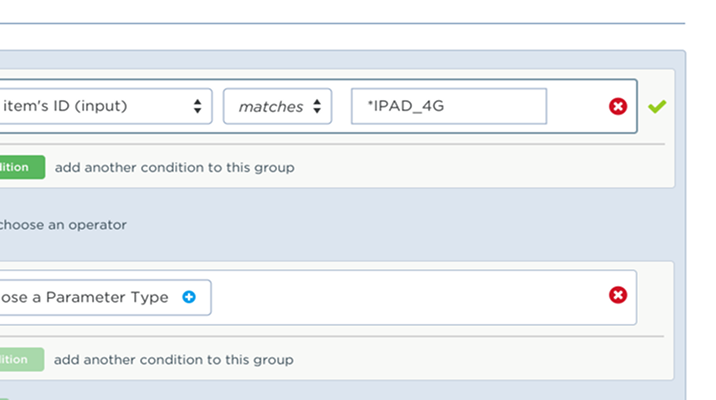

The new builder introduced nested AND / OR groupings with parenthetical insulation, allowing analysts to express complex conditions while clearly understanding how sub-rules interacted.

The master list of rules was left at the bottom of the screen so that the fraud analysts could refer to in-use logic as they build their rules, as well as an avenue for users to catch themselves before creating duplicate rules and discovering it when they attempted to save their entry.

Balancing power with safety

Because incorrect rules carried financial risk, I designed validation and feedback directly into the interaction:

-

Structural validation of rule logic

-

Parameter-level validation for custom inputs

-

Clear visual indicators for valid and invalid states

Outcome

This work enabled MaxMind to offer complex, customizable fraud automation across its customer base, including enterprise platforms serving millions of downstream merchants. Publicly available indicators show minFraud operating at massive scale, screening hundreds of millions of transactions per month, with documented customer chargeback reductions after adoption.

By enabling customer-defined rules on top of machine-learning decisions, the product evolved from passive detection into programmable fraud policy enforcement.

This project reinforced the importance of treating logic authoring as a first-class system capability rather than a constrained UI feature. Pushing for extensibility early allowed the product to survive shifting strategy, support enterprise demands, and scale in complexity without being rebuilt under pressure.

It also shaped my approach to later query-builder work, where I applied the same systems thinking in more mature design environments and for more technical audiences.